How I Smartly Funded My Kid’s Sports Training Without Breaking the Bank

Every parent wants to support their child’s passion, especially in sports. But between equipment, coaching, and travel fees, costs add up fast. I learned this the hard way—until I changed my approach. This isn’t about cutting corners; it’s about smarter financial planning. In this story, I’ll walk you through how I turned overwhelming expenses into a manageable plan, using real strategies that actually work. It started with a dream—my child’s dream to excel in competitive swimming—and evolved into a lesson in budgeting, discipline, and long-term thinking. The journey wasn’t easy, but it was worth it. And the tools we used are accessible to any family willing to take control of their finances with clarity and purpose.

The Wake-Up Call: When Passion Met Financial Pressure

When my child showed serious interest in competitive swimming, I was thrilled. Seeing that spark of dedication—early morning practices, focused laps, and growing confidence—was deeply rewarding. But within months, the excitement began to clash with reality. The first invoice from the swim academy arrived: $180 per month for group training. That seemed manageable. Then came the competition fees—$75 per meet, not including travel. Swim suits, goggles, kickboards, and training gear added another $200 in the first season alone. By the third meet, we had spent over $600 on travel, accommodation, and entry fees. What started as a joyful investment began to feel like a financial strain.

It wasn’t just the numbers—it was the unpredictability. One month, there was a regional championship requiring a three-hour drive. The next, a specialized clinic promised to improve stroke technique but cost $300 for a weekend. Each opportunity felt important, even necessary, but the cumulative effect was alarming. Our emergency fund, meant for unexpected car repairs or medical bills, was being quietly drained to cover swim meets. I realized we were reacting to expenses instead of planning for them. Enthusiasm was driving decisions, not strategy. That imbalance became unsustainable.

The turning point came during a family budget review. I laid out all our monthly commitments and noticed that sports spending now exceeded our savings contributions. That was a wake-up call. Passion shouldn’t come at the cost of financial stability. I knew we couldn’t—and shouldn’t—quit. Competitive sports build discipline, resilience, and teamwork. But supporting that growth required a smarter financial framework. I decided to treat this not as an expense, but as an investment—one that needed structure, monitoring, and clear goals. The journey to smarter funding had begun.

Rethinking Education Spending: Beyond Tuition and Books

For most families, education spending means school fees, textbooks, or college savings plans. But in today’s world, learning extends far beyond the classroom. Extracurricular activities—especially competitive sports—are powerful tools for personal development. They teach time management, goal setting, and perseverance. Yet, these programs rarely come with financial guidance. Schools don’t offer budgeting workshops for parents funding youth athletics. There’s no official roadmap for paying for a child’s passion. That gap leaves many families unprepared.

I began to see sports training not as an optional luxury, but as a legitimate form of education. Just as math and science build cognitive skills, swimming was building physical, emotional, and social intelligence. My child was learning how to handle pressure, manage setbacks, and celebrate progress—skills that would last a lifetime. Recognizing this shifted my mindset. Instead of viewing these costs as incidental, I started treating them as planned educational investments, similar to a 529 college savings plan. This reframing changed everything.

Once I accepted that sports were part of our child’s development, I could prioritize them appropriately in our budget. I stopped seeing the swim fees as an extra burden and started seeing them as a necessary line item—like music lessons, tutoring, or language classes. This didn’t mean spending more; it meant spending with intention. I began asking questions: What are our long-term goals? How long do we expect this commitment to last? What level of competition are we aiming for? These answers helped shape a realistic financial plan. I wasn’t funding a hobby—I was investing in growth, and that required strategy, not impulse.

Mapping the Real Costs: What You’re Actually Paying For

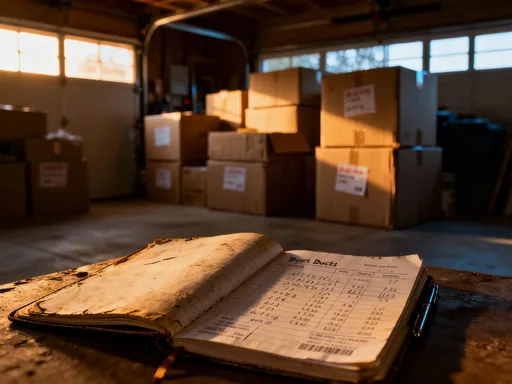

The first step in gaining control was transparency. I created a detailed list of every expense related to competitive swimming. Monthly coaching: $180. Facility access: $45. Competition entry fees: $75–$150 per event. Travel, meals, and hotels for out-of-town meets: $300–$600 per trip. Then there were the smaller, recurring costs—swim suits that fade after 30 pool hours, goggles that leak, caps that tear. Even recovery tools like foam rollers and resistance bands added up. I also included less obvious expenses: physiotherapy sessions after intense training, registration renewals, and fundraising contributions required by the swim club.

When I totaled it up, the annual cost exceeded $4,500. That was more than our annual vacation budget—and it didn’t include potential injuries, equipment upgrades, or national-level competitions. The breakdown revealed patterns. Some costs were fixed and predictable, like monthly tuition. Others were variable and situational, like travel. I categorized them accordingly. Fixed costs needed consistent funding. Variable costs required flexibility and planning. This clarity allowed me to forecast with confidence instead of reacting in panic.

I also discovered inefficiencies. For example, we were signing up for every available meet, even local ones with minimal impact on skill development. Some clinics were marketed as essential but offered only marginal improvements. By analyzing each expense through the lens of value and impact, I could identify where we were overspending. I began asking: Does this directly improve performance? Is it required for advancement? Could we achieve the same result at lower cost? These questions became filters for smarter spending. Mapping the real costs didn’t just reveal the price tag—it revealed the power of informed choices.

Building a Dedicated Fund: Strategy Over Sacrifice

Once I understood the full financial picture, I created a separate savings account exclusively for sports expenses. This was not a minor change—it was foundational. Before, swim costs were paid from our general checking account, making it easy to lose track. Now, every dollar allocated to swimming had a home. I set up an automatic monthly transfer of $200 into the fund. This amount was calculated based on the annual total divided by 12, with a small buffer for unexpected costs.

The automation was key. It removed emotion from the process. Whether we had a big grocery bill or a car repair, the transfer happened without fail. Over time, the fund grew steadily. By the end of the first year, we had saved $2,400—enough to cover most of the next year’s fixed costs. I also redirected windfalls into the account: a $500 tax refund, a $300 year-end bonus, even birthday money from relatives designated for “training support.” These one-time boosts accelerated progress without straining our regular budget.

Having a dedicated fund changed our relationship with spending. Instead of feeling guilty or anxious about swim costs, I felt in control. When a meet registration opened, I didn’t need to scramble for cash—I checked the balance and made a decision based on availability. This system also taught my child about financial responsibility. We reviewed the fund together, discussing upcoming expenses and trade-offs. It became a lesson in delayed gratification and planning. The fund wasn’t about restriction; it was about empowerment. We could pursue excellence without sacrificing security.

Smart Cost-Cutting: Where to Save Without Losing Quality

Once the foundation was in place, I focused on optimizing spending. The goal wasn’t to cut quality, but to maximize value. I discovered that many high-cost items had affordable alternatives. For example, private swim coaching cost $80 per hour, but group clinics offered similar stroke analysis for $25. I shifted to a hybrid model—group training most weeks, with occasional private sessions only when specific technique issues arose. This reduced coaching costs by 40% without compromising progress.

Equipment was another area for savings. Instead of buying new swim suits every season, I joined a local parent exchange group where families traded gently used gear. I found high-quality suits, goggles, and caps at a fraction of retail prices. I also timed purchases strategically. Major swim brands often discounted gear in the off-season or after major competitions. By waiting for sales, I saved 30–50% on essentials. Even small choices mattered: buying chlorine-resistant shampoo in bulk, using public transportation to nearby meets, packing meals instead of eating out.

I also negotiated with the swim academy. When I learned that some families paid annually, I asked about a discount for upfront payment. They offered 10% off the total if I paid for the year in advance. That saved $216. I applied the same approach to competition fees, bundling entries for multiple meets when early-bird pricing was available. I also prioritized events with the highest return on investment—those that offered rankings, exposure to scouts, or qualification for higher-level meets. Cutting costs wasn’t about doing less—it was about doing smarter, with intention and insight.

Balancing Risk and Reward: When to Invest and When to Pause

Not every opportunity deserves funding. One of the hardest lessons was learning to say no. A national development camp was offered—$1,200 for five days of elite training. It sounded impressive, but I asked critical questions: Would this significantly improve performance? Was it required for advancement? Was the timing aligned with our goals? After research, I found that the camp had no proven track record of producing elite swimmers, and many participants didn’t see measurable gains. We declined, redirecting those funds to more impactful areas.

There were also times when we paused. During a period of family financial strain—when my partner’s work hours were reduced—we scaled back to off-season training and skipped two out-of-state meets. This wasn’t a failure; it was a responsible adjustment. My child understood that some decisions are about timing and stability, not commitment. We maintained core training, preserved the habit, and resumed full participation when finances allowed. Flexibility became a strength, not a setback.

I developed a simple evaluation framework for every proposed expense: Does it directly improve performance? Is it time-sensitive? Will it open real opportunities? If two or more answers were unclear, I waited. This filter prevented impulsive spending and ensured alignment with our goals. It also reduced decision fatigue. Instead of feeling pressured to say yes to every opportunity, I could respond with confidence. Balancing risk and reward wasn’t about avoiding investment—it was about making informed, sustainable choices that protected both our finances and our peace of mind.

Long-Term Gains: More Than Just Athletic Success

Looking back, this journey was never just about funding swim training. It was about building a financial mindset that extends far beyond the pool. The habits we developed—planning, tracking, prioritizing, and reviewing—have become part of our family’s culture. We now apply the same principles to college savings, home maintenance, and even vacation planning. The discipline of setting aside money for a future goal has become second nature.

My child gained more than athletic skills. They learned the value of commitment, the importance of preparation, and the reality that meaningful goals require effort and sacrifice. They saw firsthand how planning turns dreams into achievable milestones. When they qualified for a regional championship, it wasn’t just a personal victory—it was a shared success, funded by months of consistent saving and smart choices. That sense of ownership deepened their motivation and pride.

For me, the greatest reward was confidence. I no longer fear unexpected expenses. I know we have systems in place to handle them. I’ve learned that financial control isn’t about having more money—it’s about using what you have with purpose. This experience has made our family more resilient, more intentional, and more unified in our goals. Funding a child’s passion doesn’t have to break the bank. With the right strategies, it can strengthen your finances, deepen your relationships, and build a legacy of smart decision-making—one choice at a time.