How I Navigated Taxes and Timing in My First Investment Journey

Ever felt overwhelmed trying to invest while also dodging tax traps? I did. As a beginner, I thought returns were all that mattered—until I saw how much I lost to overlooked details. Over time, I learned that smart investing isn’t just about picking assets; it’s about timing, planning, and understanding how taxes shape your real gains. This is my story of learning the hard way—so you don’t have to.

The Wake-Up Call: When My Returns Didn’t Feel Right

At the end of my first full year of investing, I opened my brokerage statement with excitement. The numbers looked strong—a 15% return on several stock positions I had held for just over a year. I imagined reinvesting those profits, maybe even treating my family to a small vacation. But when tax season arrived, the celebration faded. After accounting for capital gains taxes, my actual take-home return was closer to 10%. That 5% difference wasn’t just a number—it represented hundreds of dollars I had unknowingly surrendered. What hurt most wasn’t the tax itself, but the realization that I hadn’t planned for it. I had focused entirely on price movement and ignored how the tax system treated those gains.

This moment became a turning point. I began researching how taxation works in investment accounts, especially the difference between short-term and long-term capital gains. In many tax systems, including the U.S. federal structure, profits from assets held less than a year are taxed at ordinary income rates, which can be significantly higher than the preferential rates applied to long-term gains. For someone in a middle-income bracket, that difference could mean paying 22% versus 15% on gains—nearly half again as much in tax. Suddenly, the idea of selling quickly to lock in a win didn’t seem so smart. The lesson was clear: investment success isn’t measured by what your portfolio grows, but by what you keep after taxes. I realized that timing—how long I held an asset—was just as important as which asset I chose.

What made this even more frustrating was that I hadn’t been reckless. I had done some research before buying, read company reports, and diversified across a few sectors. But I had overlooked one critical component: the tax calendar. I sold some positions in December, not realizing that doing so triggered taxable events in that fiscal year. Had I waited until January, I might have deferred the tax liability by a full year, giving my money more time to grow. This delay could have been the difference between owing taxes this year or next, depending on my income level and tax bracket. The wake-up call wasn’t just about losing money—it was about recognizing that investing is a full-cycle process, and each phase has financial consequences.

Understanding the Investment Cycle: Phases That Shape Your Tax Bill

Every investment follows a natural life cycle: you enter (buy), you hold (wait), and you exit (sell). What many beginners don’t realize is that each of these stages carries tax implications. The moment you purchase an asset, you set the cost basis—the reference point for calculating future gains or losses. When you sell, the difference between the sale price and the cost basis determines your taxable gain or deductible loss. But it’s not just about the numbers; it’s about timing and structure. The duration of your holding period often determines how your gains are taxed, and reinvested income—like dividends or interest—can quietly create tax obligations even if you never touch the cash.

Take dividends, for example. If you own shares in a company that pays regular dividends, those payments are typically taxable in the year you receive them, even if you reinvest them automatically to buy more shares. This means your tax bill can grow even while your cash balance stays the same. I learned this the hard way when I reviewed my annual tax form and saw thousands of dollars in dividend income I hadn’t remembered receiving. I thought I was just compounding growth, but in reality, I was building a tax liability. Some dividends, known as qualified dividends, are taxed at the lower long-term capital gains rate, but only if you’ve held the stock for a minimum period—usually more than 60 days during the 121-day period surrounding the ex-dividend date. Missing that window means those dividends are taxed as ordinary income, which can be a costly oversight.

Similarly, the exit phase—selling an investment—is where timing becomes critical. Selling an asset after holding it for more than a year typically qualifies for long-term capital gains treatment, which comes with lower tax rates. But if you sell even one day too early, you could end up in the higher tax bracket for short-term gains. This isn’t just theoretical. I once sold a position on the 364th day after purchase, thinking I was close enough. I wasn’t. The IRS doesn’t round up. That single day cost me nearly 10% more in taxes on the gain. Understanding the investment cycle means seeing your portfolio not just as a collection of stocks or funds, but as a series of events, each with tax consequences. When you start viewing investing through this lens, your decisions become more deliberate, and your outcomes improve.

Tax-Aware Investing: Why Timing Matters More Than Picking Winners

Early in my journey, I obsessed over finding the next big stock—the one that would double in months. I read forums, followed market gurus, and chased momentum. But the truth is, I didn’t need to pick winners to build wealth. What I needed was patience and discipline. Once I shifted my focus from quick wins to long-term growth, I began to see better results—not because my picks improved, but because I kept more of what I earned. By simply extending my holding periods beyond one year, I qualified for lower capital gains rates. That change alone increased my after-tax returns by several percentage points across my portfolio.

Another strategy I adopted was staggering my sales. Instead of selling multiple winning positions in a single year, I spread them out over two or three tax years. This helped me avoid jumping into a higher tax bracket due to a spike in capital gains. For example, if selling all my gains in one year would push me from the 15% to the 20% long-term capital gains bracket, I could save thousands just by timing the sales. This approach required planning—I had to track holding periods and projected gains—but the payoff was worth it. I also started paying attention to tax-loss harvesting, a technique where you sell underperforming investments at a loss to offset gains elsewhere in your portfolio. This doesn’t eliminate taxes, but it can reduce your net taxable gain, effectively lowering your tax bill.

What surprised me most was how small, consistent habits created big results. I stopped making impulsive trades based on market noise. Instead, I reviewed my portfolio quarterly, checked holding periods, and aligned sales with my tax strategy. I began to think like a builder, not a trader. This mindset shift didn’t just improve my tax efficiency—it reduced my stress. I wasn’t glued to the screen waiting for the perfect exit. I knew my timeline, and I let compounding and favorable tax treatment do the heavy lifting. Over time, the combination of patience and planning delivered more reliable growth than any hot tip ever had.

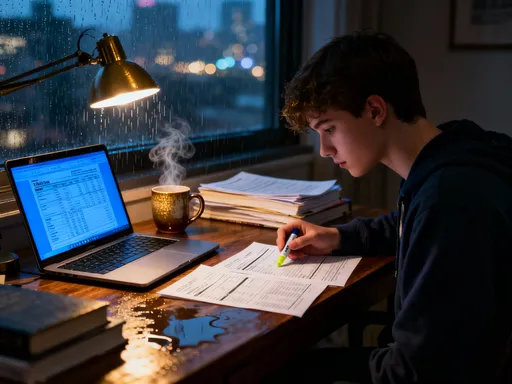

Tools That Help: Simple Ways to Track and Optimize

When I first started trying to manage taxes and timing, I felt lost. My brokerage statements were full of data, but I didn’t know how to use it. Then I discovered a simple solution: a spreadsheet. I created a basic tracker that listed every investment I owned, the purchase date, cost basis, number of shares, and current value. I added columns for estimated gain, holding period, and tax rate. At first, it took time to update, but within a few months, it became routine. This tracker became my personal investment dashboard. It showed me at a glance which positions were close to qualifying for long-term treatment, which had large unrealized gains, and which might be candidates for tax-loss harvesting.

I also began using tax software during the year, not just at filing time. Many platforms offer tools that simulate tax scenarios based on your portfolio. I could input a hypothetical sale and see how it would affect my tax bill. This allowed me to test different timing strategies without making real trades. For example, I could compare selling in December versus January and see the difference in tax liability based on projected income. These tools didn’t make me a tax expert, but they gave me confidence that I wasn’t making blind decisions. I also paid closer attention to my brokerage’s cost basis reporting, which is now required by law in many countries. This information is critical because an incorrect basis can lead to overpaying taxes.

Another powerful tool was the use of tax-advantaged accounts, such as IRAs or 401(k)s in the U.S. These accounts allow investments to grow without triggering annual taxes on dividends or capital gains. I shifted some of my longer-term holdings into these accounts, freeing up my taxable brokerage account for assets that were more tax-efficient, like individual stocks I planned to hold for years. I didn’t try to time the market—instead, I timed my account usage. By placing the right assets in the right accounts, I improved my overall after-tax returns. These tools weren’t complex or expensive. They didn’t require a finance degree. But they gave me control, and that made all the difference.

Common Traps Beginners Fall Into (And How to Dodge Them)

Looking back, I made nearly every mistake on the list. I sold a stock at a loss, then bought it back a few weeks later because I still believed in it—only to learn about the wash-sale rule. That rule disallows the tax deduction for a loss if you repurchase the same or substantially identical security within 30 days before or after the sale. My loss couldn’t be used to offset gains, and I had to adjust my cost basis upward. I lost both the tax benefit and clarity in my records. It was a frustrating lesson, but it taught me to plan trades carefully and wait out cooling-off periods.

Another trap was emotional selling near year-end. One December, the market dipped, and I panicked, selling a few positions to lock in gains before a potential drop. But that decision triggered a large tax bill, and the market rebounded in January. I paid taxes on gains I might have deferred, and I missed further upside. Now, I set a rule: no major sales in December without a written plan. I review my portfolio in October or November, identify which positions I might sell, and decide based on tax strategy, not fear. This small change has saved me from impulsive decisions.

I also ignored the tax impact of mutual funds. I didn’t realize that even if I didn’t sell my fund shares, the fund manager’s trades inside the portfolio could generate capital gains distributions—taxable events passed on to me. I received surprise tax bills because of these distributions. Now, I prefer low-turnover index funds in taxable accounts, which tend to generate fewer capital gains. I reserve actively managed funds for tax-advantaged accounts. These lessons weren’t learned overnight, but each mistake made me more aware. By sharing them, I hope others can avoid the same pitfalls.

Balancing Risk, Return, and Tax Impact

At first, I chased high yields—dividend stocks, high-interest bonds, anything that promised quick returns. But I soon realized that a high nominal return meant little if taxes and risk eroded it. A 7% return sounds great, but after a 2% tax bite and 3% in volatility drag, the real, risk-adjusted gain is much smaller. I began evaluating investments not just by their headline yield, but by their after-tax, risk-adjusted return. This meant looking at how an asset behaved in different market conditions, how often it generated taxable events, and how it fit within my overall portfolio.

Diversification took on a new meaning. It wasn’t just about spreading money across different stocks or sectors. It was also about balancing different types of income—qualified dividends, interest, capital gains—and placing them in accounts where they would be taxed most efficiently. I started viewing my portfolio as a system, not a collection of bets. I allocated assets based on both financial goals and tax efficiency. For example, I held bonds in tax-deferred accounts because their interest income is taxed as ordinary income, while I kept individual stocks in taxable accounts where I could benefit from lower long-term capital gains rates.

This holistic approach reduced both my tax bill and my stress. I wasn’t chasing every opportunity; I was building a structure that worked for me. When the market fluctuated, I didn’t panic because I knew my investments were aligned with my timeline and tax plan. The result was smoother growth and fewer surprises at tax time. I learned that real financial success isn’t about maximizing returns at all costs—it’s about optimizing the entire picture.

Building a Smarter Strategy: Lessons from My First Cycles

My early investment wins were mostly luck. I bought a few stocks that went up, sold them, and felt smart. But luck doesn’t scale. My later gains came from design—from a strategy built on patience, planning, and tax awareness. Today, I plan my exits as carefully as I plan my entries. I watch holding periods like a gardener watches seasons—knowing that timing and conditions matter. I treat tax deadlines not as burdens, but as signals to review my portfolio and make intentional decisions.

I’ve learned to let time work for me. The power of compounding is amplified when you minimize taxes each year. By deferring gains, harvesting losses, and using tax-advantaged accounts wisely, I’ve increased my after-tax returns without taking on more risk. I no longer measure success by quarterly statements, but by long-term progress toward my goals. I invest with my family in mind—not just for vacations or gifts, but for stability, education, and peace of mind.

This journey didn’t require genius or luck. It required attention to detail, a willingness to learn, and the discipline to stick with a plan. I share these lessons not as a financial expert, but as someone who made the mistakes so you don’t have to. Investing is personal, but the principles of timing, tax efficiency, and thoughtful planning are universal. When you align your investment rhythm with the logic of the tax system, you don’t just grow wealth—you protect it. And that makes all the difference.