How I Mastered My Renovation Budget Without Losing Sleep

You’ve finally decided to renovate—excitement kicks in, then reality hits: the budget. I’ve been there, staring at quotes that doubled my expectations, wondering how to keep my dream upgrade from becoming a financial nightmare. What if you could cut costs without cutting corners? This is the system I built from trial, error, and real-life wins—not theory—that helped me optimize every dollar spent, stay in control, and actually enjoy the process. It’s not about doing the cheapest job possible. It’s about making smart, intentional choices that align with your financial goals and home’s long-term value. By treating renovation as a structured financial project rather than a spontaneous upgrade, I avoided stress, minimized surprises, and completed my remodel on time and under budget. This guide shares the exact framework that made it possible.

The Hidden Cost Trap in Home Renovations

One of the most common reasons home renovations spiral out of control is the failure to account for hidden costs. Many homeowners focus only on the visible expenses—new cabinets, flooring, lighting—and overlook the less obvious but equally critical components. Permits, design fees, waste disposal, temporary housing, and even increased utility costs during construction can quietly add up. These soft costs often account for 10% to 20% of the total project budget, yet they are frequently omitted from initial estimates. When these are ignored, the budget appears manageable at first, only to become unworkable once the project is underway.

Another major factor is timeline overruns. Delays in material delivery, weather disruptions, or contractor scheduling conflicts can extend the project duration, leading to additional labor charges, storage fees, or even temporary rental costs if the home becomes uninhabitable. Each extra week of work can add hundreds or even thousands of dollars to the final bill. Emotional spending also plays a significant role. The excitement of choosing finishes, fixtures, or layout changes can lead to impulsive upgrades that weren’t in the original plan. A $200 backsplash turns into a $1,200 mosaic tile installation simply because it “looked amazing” in the showroom. These small decisions, when repeated, erode the budget rapidly.

The solution lies in adopting a holistic financial mindset. A renovation should not be viewed as a single expense but as a financial project with multiple moving parts. Just as a business evaluates capital expenditures, homeowners should assess renovations with the same level of scrutiny. This means creating a comprehensive cost model that includes all possible expenses, assigning probabilities to risks, and building in contingency funds. It also means setting clear financial boundaries before work begins and sticking to them. By understanding that every decision has a cost—not just in dollars but in time and future maintenance—homeowners can make more informed, rational choices that protect their financial well-being.

Building Your Financial Framework Before the First Nail Is Hammered

The foundation of a successful renovation budget is laid long before any construction begins. It starts with defining clear priorities and establishing a realistic financial ceiling. Many homeowners jump into the process by browsing design magazines or visiting showrooms, but this approach often leads to overspending because it prioritizes inspiration over practicality. Instead, the first step should be an honest assessment of needs versus wants. Is the kitchen outdated and inefficient, or is it simply a desire for a more modern look? Does the bathroom have structural issues, or is the upgrade purely aesthetic? Distinguishing between essential repairs and lifestyle enhancements allows for smarter allocation of funds.

A tiered budgeting system is one of the most effective tools for maintaining control. This approach divides spending into three categories: essential, upgrade, and optional. The essential tier includes non-negotiable items such as structural repairs, code-compliant electrical work, or necessary plumbing updates—elements that ensure safety, functionality, and compliance with local regulations. The upgrade tier covers improvements that enhance comfort or efficiency, such as energy-saving windows or a more functional kitchen layout. The optional tier includes purely aesthetic choices, like designer lighting fixtures or luxury flooring, which can be deferred or eliminated if the budget tightens.

Aligning spending with long-term home value is another critical consideration. Not every renovation pays off in resale value. According to real estate data, kitchen and bathroom remodels typically offer the highest return on investment, often recouping 60% to 80% of costs when the home is sold. In contrast, high-end finishes or overly personalized designs may not appeal to future buyers and can actually limit marketability. Therefore, it’s wise to balance personal taste with market trends. Using a simple decision matrix—rating each potential upgrade on criteria like cost, durability, maintenance, and resale impact—can help homeowners make objective choices rather than emotionally driven ones. This structured approach ensures that every dollar spent contributes meaningfully to both immediate enjoyment and long-term financial health.

Strategic Sourcing: Where to Buy and Where to Skip

One of the most powerful ways to control renovation costs is through strategic sourcing. Not every material or fixture needs to come from a premium retailer. In fact, some of the highest-visibility elements—like countertops or flooring—can be purchased at significant discounts without sacrificing quality. The key is knowing where to splurge and where to save. High-impact areas that guests notice, such as the kitchen island or entryway flooring, may justify a higher investment. Low-visibility areas, like attic insulation or behind-wall plumbing, are ideal candidates for cost-effective alternatives.

Reclaimed and surplus materials offer excellent opportunities for savings. Salvage yards, online marketplaces, and end-of-season clearances often carry high-quality items at a fraction of retail prices. A solid wood door, vintage light fixture, or clawfoot tub can add character and charm without the premium price tag. Off-season purchasing is another smart strategy. Buying roofing materials in winter or air conditioning units in fall can yield discounts of 20% or more, as suppliers clear inventory. Similarly, direct supplier deals—bypassing contractors who mark up materials—can save 10% to 30% on items like tile, cabinets, or appliances.

Real-world examples demonstrate the impact of these choices. One homeowner saved over $4,000 by switching from imported marble to a high-quality quartz alternative with a similar appearance. Another cut flooring costs in half by choosing engineered hardwood instead of solid wood, with no visible difference to visitors. These decisions didn’t compromise the final result; they simply reflected smarter spending. The lesson is clear: research, comparison shopping, and flexibility in design choices can unlock substantial savings. By treating material selection as a financial decision rather than a purely aesthetic one, homeowners gain greater control over the overall budget and reduce the risk of overspending on elements that don’t add proportional value.

Contractor Dynamics: Managing Quotes, Timelines, and Hidden Fees

Selecting the right contractor is one of the most critical financial decisions in a renovation. A low bid might seem attractive, but it can come with hidden risks such as subpar workmanship, delays, or unexpected change orders. Conversely, a higher quote may include greater transparency, better materials, and more reliable scheduling. The key is to evaluate bids holistically, not just by price. This means reviewing the scope of work in detail, ensuring that all major tasks are included, and confirming whether permits, cleanup, and disposal are covered. A vague or incomplete proposal is a red flag, as it leaves room for later cost additions.

Payment schedules are another area where financial discipline is essential. A reputable contractor will typically request a small deposit—no more than 10% to 15%—with the balance paid in phases tied to project milestones. This structure protects the homeowner by ensuring that funds are released only as work is completed and verified. Avoid contractors who demand large upfront payments or full payment before work begins, as this increases financial risk and reduces leverage if problems arise. A clear contract should also outline the change order process, specifying how additional work will be priced and approved. Without this, even minor requests can lead to significant cost overruns.

Transparency and communication are vital throughout the project. Regular updates, whether through site visits or digital reports, help maintain trust and prevent misunderstandings. If delays occur, a good contractor will notify the homeowner promptly and provide a revised timeline. Hidden fees often emerge when communication breaks down—such as when unforeseen structural issues are discovered but not discussed until the final invoice. To avoid this, build in a contingency fund of 10% to 15% of the total budget specifically for unexpected repairs. This proactive approach reduces stress and ensures that surprises don’t derail the financial plan. By treating the contractor relationship as a partnership based on clear expectations and mutual accountability, homeowners can maintain control over both quality and cost.

DIY vs. Pro: Drawing the Line to Save Money and Stress

Doing some of the work yourself can be an effective way to reduce labor costs, but it’s important to know where to draw the line. Tasks like painting, demolition, or installing backsplashes are often manageable for homeowners with basic skills and the right tools. These activities require minimal technical knowledge, pose low safety risks, and can be completed without affecting structural or system integrity. Taking on such work not only saves money but can also be personally rewarding, giving homeowners a deeper sense of ownership over the renovation.

However, certain tasks should never be attempted without professional expertise. Electrical wiring, plumbing, gas line installation, and structural modifications require licensed professionals for both safety and legal reasons. Mistakes in these areas can lead to serious hazards, including fire, water damage, or code violations that could complicate future home sales. Moreover, rework costs from DIY errors often exceed the original professional fee, turning a short-term saving into a long-term financial burden. For example, improper wiring may require a full rewiring job, costing thousands more than hiring an electrician from the start.

Time is another critical factor in the DIY decision. While labor costs are avoided, the homeowner’s time has value. A weekend project that stretches into weeks due to inexperience can disrupt daily life and delay the overall timeline. This opportunity cost—time that could be spent working, resting, or with family—should be factored into the decision. A practical framework for choosing between DIY and professional help includes assessing skill level, tool availability, safety risk, and time commitment. When in doubt, it’s better to consult a professional for a quote before committing to a task. This balanced approach ensures that cost savings don’t come at the expense of safety, quality, or peace of mind.

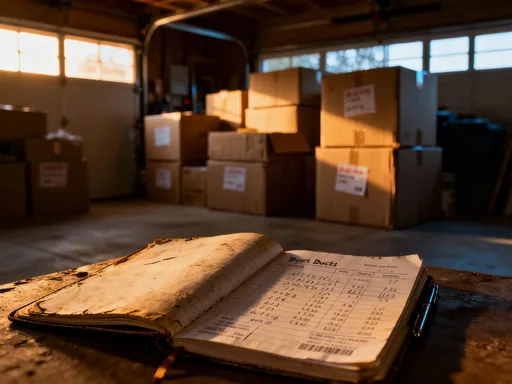

Monitoring and Adjusting: The Real-Time Budget Tracker That Works

A renovation budget is not a static document—it must evolve as the project progresses. Relying solely on an initial estimate is a recipe for financial surprises. Instead, active monitoring is essential. This means tracking every expense in real time, comparing actual spending to projections, and adjusting plans as needed. A simple spreadsheet or budgeting app can serve as a powerful tool for this purpose. Each line item—materials, labor, permits, delivery fees—should be logged as it occurs, with notes on any deviations from the original plan.

The buffer rule is a key principle in this process. Allocate a contingency fund of 10% to 15% of the total budget at the outset, and treat it as a last resort. When unexpected costs arise, they should be drawn from this buffer rather than from other categories. This prevents one overrun from cascading into multiple budget cuts elsewhere. Regular check-ins—weekly or biweekly—help maintain awareness and allow for early intervention. If a particular category is trending over budget, adjustments can be made immediately, such as switching to a less expensive material or postponing a non-essential upgrade.

This real-time tracking system fosters accountability and reduces stress. It transforms the renovation from a financial black box into a transparent, manageable process. Homeowners who use this method report greater confidence in their decisions and fewer last-minute financial shocks. More importantly, it reinforces financial discipline by making every spending choice visible and intentional. Over time, this habit of tracking and adjusting becomes a valuable skill that extends beyond home improvement, contributing to overall financial well-being.

Long-Term Value: When Spending More Actually Saves Money

True financial wisdom in renovation isn’t just about cutting costs—it’s about investing wisely. Some upgrades, while more expensive upfront, deliver long-term savings and increased home value. Energy-efficient windows, high-quality insulation, and modern HVAC systems reduce utility bills over time, often paying for themselves within a few years. According to energy studies, homeowners who invest in comprehensive insulation and sealing can save 20% to 30% on heating and cooling costs annually. Similarly, durable materials like porcelain tile, quartz countertops, or metal roofing require less maintenance and replacement, reducing long-term ownership costs.

Resale value is another critical consideration. While personal taste matters, certain improvements have proven market appeal. A well-designed kitchen with functional storage, ample lighting, and modern appliances tends to attract buyers and justify a higher sale price. Bathroom remodels with accessible features, water-saving fixtures, and timeless design also perform well in the market. These are not just lifestyle upgrades—they are strategic investments in the home’s future worth. In contrast, overly customized features, such as themed rooms or niche materials, may not resonate with future buyers and could even deter them.

The distinction between cost and value is essential. A $5,000 lighting fixture may be expensive, but if it doesn’t enhance functionality or appeal, it’s a cost with little return. On the other hand, a $7,000 solar water heater may have a higher price tag, but it reduces monthly expenses and increases sustainability, delivering ongoing value. By evaluating each decision through this lens, homeowners shift from reactive spending to proactive wealth building. Renovation becomes not just a home improvement project, but a financial strategy—one that enhances comfort, efficiency, and long-term stability.

The journey of renovating a home doesn’t have to be a financial gamble. With the right framework, it can be a controlled, empowering experience that strengthens both the living space and the household budget. By recognizing hidden costs, building a structured financial plan, sourcing strategically, managing contractor relationships, making informed DIY choices, monitoring spending in real time, and investing in long-term value, homeowners can achieve their vision without sacrificing financial security. This system isn’t about perfection—it’s about progress, discipline, and clarity. When applied consistently, it transforms renovation from a source of stress into a confident, rewarding achievement. The result is not just a better home, but a stronger financial foundation for the years ahead.