Cashflow Armor: How I Reinvented My Emergency Fund Strategy

Let’s be real—life doesn’t care about your budget. A flat tire, a surprise bill, or a sudden job shift can wreck your finances overnight. I learned this the hard way. What started as a small cushion turned into a strategic reserve after years of trial and error. This isn’t just about stashing cash—it’s about building financial resilience. Here’s how I transformed my emergency fund from reactive savings to proactive financial armor. It’s not magic, and it doesn’t require a six-figure income. It requires clarity, consistency, and a shift in mindset—from seeing savings as passive to treating them as active protection. That shift changed everything.

The Wake-Up Call: Why Emergency Funds Are More Than Just Savings

For years, I followed the standard advice: save three to six months of living expenses and call it a day. I tucked money away when I could, dipped into it when things got tight, and never thought much about structure. Then came the winter when the furnace failed, my daughter needed unexpected dental work, and I was laid off from a contract role—all within six weeks. Suddenly, that three-month cushion evaporated. I wasn’t just stressed; I was paralyzed. I had numbers on a screen, but no real plan for when multiple emergencies hit at once. That experience forced me to ask: was I really prepared, or just pretending?

What I discovered is that most people treat emergency funds like a fire extinguisher—something you keep in the closet until disaster strikes. But in reality, financial emergencies aren’t always dramatic. They’re often a series of small, compounding pressures: a medical co-pay here, a car repair there, a rent increase that pushes your monthly balance into the red. The traditional rule of thumb—three to six months of expenses—assumes a one-time shock, not the layered stress many families face. It also fails to account for personal circumstances like job volatility, health conditions, or geographic cost of living. For a single parent in a high-rent city, six months might still not be enough. For someone with stable income and minimal debt, it might be overkill.

The real purpose of an emergency fund isn’t just to cover expenses—it’s to preserve your long-term financial trajectory. Without it, a single setback can trigger a cascade: missed payments, credit damage, high-interest borrowing, and delayed goals like homeownership or retirement. A well-structured emergency fund acts as a circuit breaker, stopping that chain reaction before it starts. It’s not about avoiding hardship; it’s about maintaining control when hardship arrives. That realization led me to rethink not just how much to save, but how to design the fund itself—making it dynamic, personalized, and resilient enough to handle real-life complexity.

Redefining the Emergency Fund: From Static Cushion to Active Defense

An emergency fund is often described as a safety net, but that metaphor is too passive. Nets catch you when you fall, but they don’t help you get back up. A better image is armor—something that moves with you, adapts to threats, and gives you the confidence to keep moving forward. That means redefining what the fund is for and what it isn’t. At its core, an emergency fund exists to cover essential expenses during unplanned disruptions. These include job loss, urgent medical costs, critical home or car repairs, and other unavoidable events that threaten your financial stability. It is not for vacations, holiday shopping, or upgrading your phone. It is not a down payment fund or a backup for poor budgeting.

Liquidity is the defining feature. The money must be accessible within days, without penalties or market risk. That rules out long-term investments, certificates of deposit with early withdrawal fees, or retirement accounts. The goal isn’t growth—it’s reliability. When your car breaks down on a Tuesday, you need cash by Wednesday. That’s why high-yield savings accounts, money market funds, or even a dedicated checking account are ideal homes for these funds. They offer modest interest without sacrificing access. The return isn’t the point; the protection is.

Another key shift is mindset: your emergency fund is not idle money. It’s working for you every day by reducing stress, preventing debt, and enabling better decision-making. When you know you’re covered, you’re less likely to panic-sell investments during a market dip or accept a toxic job out of desperation. This fund is the foundation of all other financial strategies. Without it, even the best investment plan can unravel under pressure. With it, you gain the freedom to take calculated risks—like switching careers, starting a side business, or pursuing further education—because you’re not one setback away from financial freefall. It’s not just about surviving emergencies; it’s about thriving despite them.

Layered Liquidity: Building a Tiered Reserve System

One of the biggest flaws in traditional emergency planning is treating the fund as a single pool of money. In reality, not all emergencies are the same. Some require immediate cash—like a flat tire or an urgent prescription. Others unfold over weeks or months, like a job search after layoffs. A one-size-fits-all approach leads to either overexposure or under-preparation. That’s why I adopted a tiered liquidity model, dividing my emergency reserves into three distinct layers, each with a specific purpose and access level.

The first layer is immediate access—cash or equivalents available within 24 to 48 hours. I keep this in a dedicated checking account linked to my primary bank. It covers small, urgent needs: a co-pay, a home repair deposit, or a transportation cost when public transit fails. The amount is modest—around $1,000—enough to handle most surprise expenses without touching the larger reserve. Because it’s in a checking account, it earns little to no interest, but that’s acceptable. Speed matters more than return here.

The second layer is the short-term buffer, designed for disruptions lasting a few weeks. This sits in a high-yield savings account, earning a competitive interest rate while remaining liquid. I keep two months’ worth of essential expenses here—enough to cover rent, groceries, utilities, and insurance if income stops. Transfers to my checking account take one to three business days, which is fine for planned withdrawals. This layer acts as the main response unit during a crisis, handling the bulk of ongoing costs while I assess the situation.

The third layer is the extended safety net, reserved for prolonged emergencies like long-term unemployment or major medical events. This portion is held in short-term Treasury bills or a stable-value money market fund, slightly less liquid but still low-risk. It covers an additional three to four months of expenses and is only accessed if the second layer is depleted and recovery will take time. The slight delay in access is a feature, not a bug—it creates a psychological barrier against impulsive use. Together, these layers create a graduated response system, ensuring I never have too little when I need it most, and never too much sitting idle when I don’t.

Risk Mapping: Identifying Personal Financial Threats Before They Hit

No two emergency funds should look the same, because no two lives face the same risks. A young freelancer in a volatile industry needs a different strategy than a tenured teacher with a pension. That’s why the next step in building true financial armor is risk mapping—taking a clear-eyed look at the specific threats most likely to disrupt your income or increase your expenses. This isn’t about fear-mongering; it’s about preparedness. By identifying your vulnerabilities in advance, you can size your fund appropriately and respond faster when trouble comes.

I started by listing my top financial risks: job instability in my field, chronic health conditions in my family, aging home systems, and rising local property taxes. For each, I estimated the potential financial impact. How long would it take to find a new job? What are the out-of-pocket costs for a hospital stay? How much would a new roof or HVAC system cost? I didn’t guess—I researched. I looked at local repair averages, insurance deductibles, and unemployment trends. This gave me a realistic range of potential outflows, not just a generic “three months of expenses.”

Then I assessed likelihood. Job loss felt probable, given contract work. Major home repairs were inevitable—just a matter of when. Medical emergencies were less likely but high-cost, so they warranted a buffer. Geographic factors also played a role: I live in an area prone to winter storms, which can lead to power outages, heating failures, and temporary work disruptions. Each of these factors influenced how much I needed and how I structured access. For example, knowing that storms could knock out income for days, I prioritized immediate liquidity in my first layer.

This process also revealed gaps in my overall safety net. I realized my health insurance had a high deductible, so I increased my short-term buffer to cover that exposure. I also saw that my home warranty didn’t cover plumbing, so I added a small earmark for potential repairs. Risk mapping didn’t just size my fund—it improved my entire financial strategy. It led me to strengthen insurance coverage, diversify income streams, and even relocate some savings to a bank with better mobile access in case of power outages. Preparedness isn’t just about money; it’s about systems.

Funding Smart: Automated Inflows Without Sacrificing Lifestyle

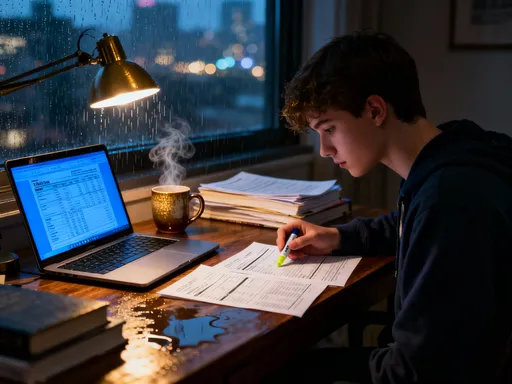

Building a robust emergency fund doesn’t require drastic lifestyle cuts. In fact, the most sustainable approach is the one you don’t feel. The key is automation—treating your emergency savings like a non-negotiable bill. Every time I get paid, a fixed percentage goes directly into my high-yield savings account. It happens before I see the money, so there’s no temptation to spend it. This “pay yourself first” model ensures steady growth without willpower.

I started small—just 3% of my income—and increased it by 1% every six months as my budget adjusted. The rise was gradual, so my lifestyle never felt restricted. Over time, compounding interest and consistent contributions made a noticeable difference. I also set up a secondary automation: 50% of any windfall—tax refunds, bonuses, rebates, or side income—goes straight into the extended safety net. This accelerates growth without disrupting monthly cash flow.

Behavioral finance teaches us that we’re more likely to stick with habits that feel painless. That’s why I avoid thinking of this as “sacrifice.” Instead, I frame it as self-protection. Every dollar saved is a dollar that won’t need to be borrowed at 20% interest later. I also track progress visually, using a simple chart to mark milestones. Reaching $5,000 felt like an achievement. Hitting three months of expenses was a turning point. These wins reinforced the habit.

Another smart funding tactic is expense redirection. Whenever I pay off a debt or cancel a subscription, I redirect that amount into savings. For example, when my car loan ended, the $300 monthly payment didn’t vanish—it moved to my emergency fund. This leverages existing cash flow, making savings feel like a natural next step rather than a new burden. Over two years, these small shifts added over $10,000 to my reserve without a single lifestyle downgrade. The lesson? You don’t need more money to build security—you need better systems.

Guarding the Gate: Rules for Withdrawing—And Not Abusing—the Fund

Having money set aside means nothing if you can’t protect it from yourself. The biggest threat to an emergency fund isn’t inflation or low interest—it’s misuse. Without clear rules, it’s easy to justify “emergency” spending for things like holiday gifts, home upgrades, or impulse purchases. That’s why I established strict withdrawal criteria and a formal replenishment process. These rules aren’t punitive; they’re protective. They preserve the fund’s integrity so it’s there when I truly need it.

My definition of a true emergency is simple: it must be unexpected, essential, and urgent. A broken water heater? Yes. A desire to remodel the kitchen? No. A medical bill? Yes. A vacation deal too good to pass up? No. I also require documentation—keeping receipts and notes for every withdrawal. This creates accountability and helps me spot patterns. For example, if car repairs keep coming from the fund, it may be time to adjust my maintenance budget or set up a separate sinking fund.

Emotional spending is another danger. Stress, excitement, or social pressure can lead to poor decisions. I built in a 48-hour cooling-off period for any withdrawal over $500. During that time, I review the situation, consult my spouse, and confirm it meets the emergency criteria. This pause has stopped multiple near-misses, like nearly using the fund for a last-minute flight to a family event that wasn’t urgent.

Replenishment is equally important. Once I use part of the fund, I create a repayment plan—usually by increasing my automated transfer for three to six months until the balance is restored. This closes the loop and reinforces discipline. The fund isn’t a one-time achievement; it’s a living system that requires maintenance. By guarding the gate, I ensure it remains a source of strength, not a false sense of security.

Beyond the Cushion: How a Strong Reserve Empowers Bigger Financial Moves

The greatest benefit of a well-built emergency fund isn’t what it protects you from—it’s what it enables you to pursue. Financial security doesn’t come from how much you earn or invest. It comes from knowing you can handle whatever comes. That confidence changes everything. With my layered reserve in place, I’ve made bolder, smarter decisions: I left a stable but unfulfilling job to start a consulting business. I invested in a rental property without panic during a market dip. I supported my child’s education without draining retirement accounts.

This fund didn’t just prevent disaster—it created freedom. It allowed me to take strategic risks because I knew I had a buffer. When your safety net is strong, you don’t have to say yes to every opportunity out of fear. You can wait for the right one. You can negotiate better terms. You can walk away from bad deals. That’s the paradox of financial security: the more protected you are, the more willing you become to grow.

For families, this stability is even more powerful. It means fewer arguments about money. It means being able to help a child with a car repair without derailing your own goals. It means sleeping better at night, knowing that if the furnace fails again, you’re ready. Peace of mind isn’t a luxury—it’s a foundation. And it’s available to anyone willing to build it, one automated transfer at a time.

In the end, financial resilience isn’t about perfection. It’s about preparation. It’s about designing a system that works for your life, not against it. My emergency fund is no longer a passive stash of cash. It’s active armor—flexible, layered, and always on duty. It doesn’t promise a life without problems. But it does promise that when problems come, I won’t be defenseless. And that makes all the difference.